The Bloom Is Off The Rows

The Bloom Is Off The Rows

InvestingCattle_fi

According to the Chicago Fed, farmland values in the bellwether Seventh District have tapered off thanks in part to lower commodity prices. The lone exception? Farms and ranches where those same commodities are nurturing valuable livestock. — The Editors

NATIONAL — TREND

According to the USDA, corn prices fell 37 percent and soybean prices dropped 8.5 percent in the first quarter of 2014 from a year ago.

Meanwhile, milk, hog, and cattle prices “have risen dramatically” over that same period: 31 percent, 48 percent, and 19 percent higher, respectively.

MIDWEST — FOCUS

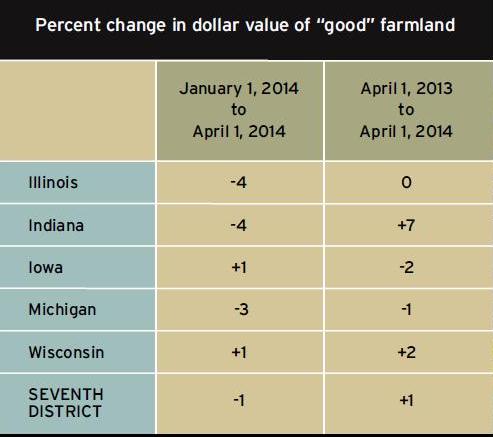

One of the many implications of these lower grain prices is that during the first quarter of 2014 agricultural land values in the Seventh District rose by just 1 percent from a year ago. The year-over-year increase was the smallest in five years: since the third quarter of 2009.

But falling grain prices also mean lower feed costs, a boon to livestock producers. This in turn buoyed farmland prices in areas where the agricultural mix includes a significant livestock component.

P.S. On November 17, 2014, the Federal Reserve Bank of Chicago will hold a conference to examine the role of farm income in the economy of the rural Midwest. Details are forthcoming on www.ChicagoFed.org and in the next issue of the Seventh Federal Reserve District’s AgLetter.